Family Limited Partnerships (FLPs)

By Callie Morgan CFP®

A Family Limited Partnership (FLP) is a common estate planning tool that is widely used among families with complex assets to not only manage but to transfer wealth to heirs while maintaining control over assets and minimizing estate and gift taxes. Utilizing a FLP allows the family to consolidate assets, protect wealth from creditors, and provide business succession planning.

Structure of a Family Limited Partnership

A FLP is similar to a traditional limited partnership in the way it is structured because both have two types of partners:

- General Partner (GP): The general partner is an individual or an entity (such as a Limited Liability Company [LLC]) which manages the partnership. The GP controls the investment and business decisions and bear unlimited liability. Typically, parents or grandparents act as a general partner.

- Limited Partner (LP): The limited partner is an individual or an entity (such as an irrevocable trust) which owns interest in the partnership but has no control over management. The liability is limited to the ownership and is usually owned by the GP’s children.

How a Family Limited Partnership Works

Parents or senior family members establish the family limited partnership as the general partner and contribute assets such as real estate, business interests, investments, or cash. Once established, the general partner will retain a small interest (1-5%) to maintain control over the partnership and gradually gift or sell the limited partnership interests to their heirs.

Valuation Discounts

One advantage FLPs offer is a valuation discount on limited partnership interest when transferred to heirs. There are different discounts that can be applied to the partnership and the discount can range from 10-45% depending on various factors. Some commonly used valuation discounts are:

- Lack of Marketability Discount: Limited Partnership interest is considered a closely held asset which cannot be easily sold on the open market. Because of this, a discount may be applied to the limited partner.

- Lack of Control (Minority Interest) Discount: Limited partners have no control over how the business operates; this also allows for a discount to be applied.

Combining both discounts permit families to significantly lower the taxable value of transferred interest resulting in a reduction in estate and gift tax exposure. Before a discount can be determined, a valuation must be obtained by a qualified business appraiser.

Estate and Income Tax Implications

- Estate Tax Benefits: One of the primary advantages of a Family Limited Partnership is its ability to reduce estate tax liability by shifting assets downstream to the next generation. By gifting the limited partnership interest to heirs, the parent or senior family member is able to exclude any future appreciation of the asset from their estate. In other words, as the value of the assets grow overtime, the increased value will not incur additional estate taxes. Furthermore, FLPs allow families to utilize the annual gift tax exclusion ($19,000 per person/$38,000 per married couple in 2025) and the lifetime gift tax exemption amount ($13.99MM per person/$27.98MM per married couple in 2025).

- Income Tax Considerations: From an income tax perspective, a FLP is a passthrough entity, meaning it does not pay tax at the partnership level but rather passes income down to its partners. Income and losses are passed through to the partners based on their specific ownership and reported on their individual tax returns. This allows families to strategically shift income to lower-income family members, potentially reducing the overall tax burden. Seeking guidance and support from a tax professional and financial team is critical to ensure compliance with IRS rules.

Example of a Family Limited Partnership

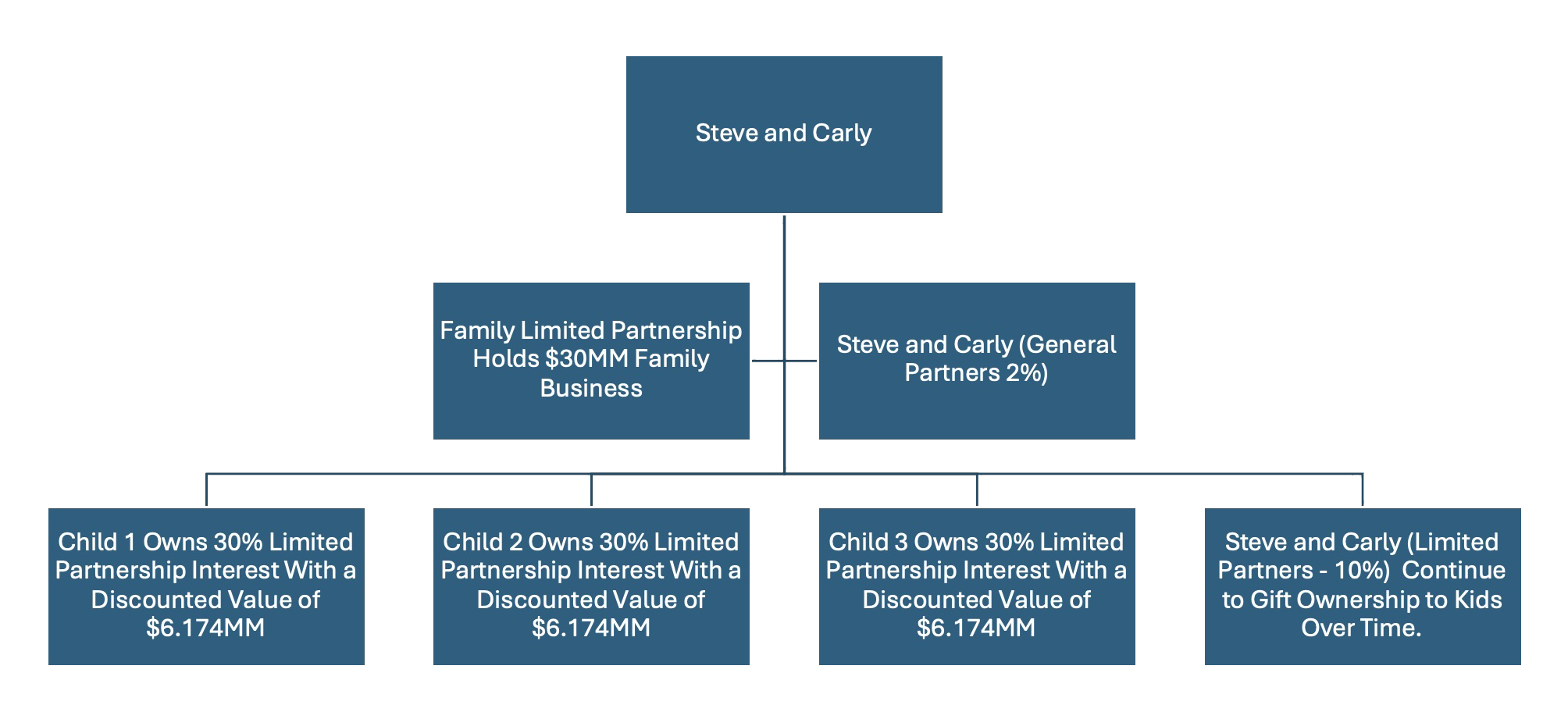

Steve and Carly own a family-owned business valued at $30 million. They want to transfer some of the ownership to their three children while minimizing estate tax and protecting the legacy they built.

- Step 1: Establish the FLP

- After consulting with an estate planning attorney, tax advisor, and financial advisor, Steve and Carly contribute their business to a FLP. They retain 2% general partner interest to maintain control of the business and hold a 98% limited partnership interest which they plan to gift to their children over time.

- Step 2: Applying Discounts and Gifting Interest

- With the valuation discounts, they were able to apply a 30% discount on the LP interest. Instead of the 98% LP interest being valued at $29.4MM, it is instead appraised at $20.58MM (($30MM X 98%)-30%). Steve and Carly decide to gift 30% of the LP interest to each child. This gift resulted in transferring a total of $27MM to their children with a discounted value of $18.522MM and allowed one spouse to take advantage of their full lifetime exemption amount and the other spouse to utilize a portion of their exemption.

- Step 3: Estate and Income Tax Benefits

- The reduced valuation lowers Steve and Carly’s taxable estate, future business appreciation is outside of their estate for estate tax purposes, and the FLP income is distributed to their children at their lower rates.

Conclusion

Family Limited Partnerships offer a powerful solution for managing and transferring wealth while reducing estate and gift tax liabilities. By leveraging valuation discounts and retaining control, families can pass down assets efficiently. Proper legal and tax planning are essential for this strategy to work appropriately and to ensure compliance with IRS rules. Reach out to a Southside Wealth Management & Trust Officer today to learn more.

The information provided in this article is for general informational purposes only and should not be construed as financial advice. Before making any financial decisions, it is strongly recommended that you consult with a certified financial planner™, attorney, accountant, or another trusted financial professional to assess your individual circumstances.

We want you to know that investment products provided by Southside Wealth Management & Trust: Are Not Insured by the FDIC or Any Federal Government Agency | May Lose Value | Are Subject to Risk | Are Not Bank Guaranteed | Are Not Deposits

Most Recent

Southside Bank Announces Relocation of Granbury Branch to Newly Constructed Facility

Southside Bank announced the relocation of its Granbury branch to a newly constructed, standalone facility designed to better serve its...

Southside Bank Announces Opening of New Branch in West Tyler’s Bellwood Park Development

Southside Bank is pleased to announce the opening of its newest branch in the Bellwood Park area of west Tyler....

Building Financial Security: Key Milestones at Every Stage of Life

By Callie Morgan, CFP®Financial planning is a lifelong process, and certain milestones serve as critical checkpoints for reviewing and adjusting...

Holiday Recipes That Don't Break The Bank

The holiday season is here again! It’s a magical time where we get to make good memories and great food....