FDIC-Insured - Backed by the full faith and credit of the U.S. Government

FDIC-Insured - Backed by the full faith and credit of the U.S. Government

Your banking made simple. Our Classic Checking account is designed for your everyday needs.

Check Current Rates

Some of our checking accounts can earn interest to help grow your balance. Click below to check out our rates.

You're doing big things in life, so you need banking that keeps up. Our digital banking makes it easy to manage your finances any time and place that works for you.

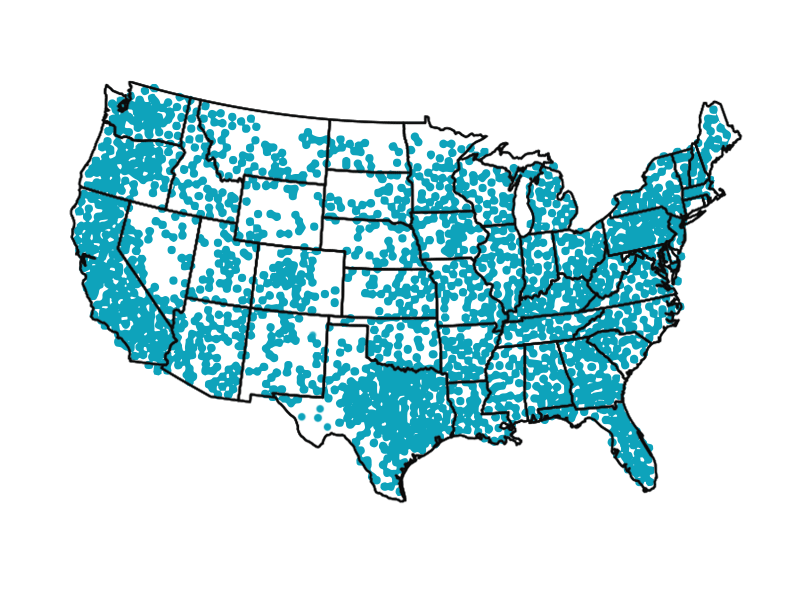

With your Southside Bank debit card, you get access to the Allpoint® and 7-Eleven® network of 60,000 surcharge-free ATMs nationwide.3

Zelle® is a fast4, safe and easy way to send and receive money with people you trust regardless of where they bank4.

They know me by name and always greet me with a smile. Their customer service and patience sets them apart from other Banking Establishments. When I arrive in the drive-thru I am always greeted FIRST!

- Valerie M.

They know us by name, remember our preferences, and make every interaction feel special and tailored to us. It's not just about transactions; it's about building genuine connections. Even my children eagerly anticipate our visits!

- Dereon H.

I have never felt more appreciated or cared for by any other bank. The customer service is fantastic and I am a real person to them and not just a number on a page. Switching to this bank is the best thing I have ever done.

- Julia H.

**Overdraft privilege is available on the accounts marked accordingly above. Overdraft privilege is not available on estate and trust accounts. A Paid Overdraft Item Fee of $30 will be assessed for each withdrawal that is paid into the overdraft by check, in-person withdrawal, ACH withdrawal, or other electronic means (only includes ATM and everyday debit card withdrawals if you give us your consent), which may result in multiple Overdraft Charges on the same day. Southside Bank reserves the right not to pay an overdraft item if an account is not in good standing, if regular deposits are not made, or if repeated overdrafts occur. Overdrafts should be paid promptly.

1 Cell phone protection and personal identity protection are subject to additional terms and conditions.

2 Insurance products are NOT FDIC INSURED, NOT A DEPOSIT, NOT AN OBLIGATION OF OR GUARANTEED BY SOUTHSIDE BANK, ITS AFFILIATES, OR ANY GOVERNMENTAL AGENCY.

3 ATM network is surcharge-free for Southside Bank customers when using their debit card to withdraw cash. When you use an ATM not owned by us, you may be charged a fee by the ATM operator or any network used (and you may be charged a fee for a balance inquiry even if you do not complete a funds transfer).

4 U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license.