The Power of Compounding Interest: Growing Wealth Over Time

By Callie Morgan, CFP®

Compounding interest is one of the most powerful tools an individual has available to use; capable of turning modest savings into substantial wealth over time.

To fully harness its power, it’s important to understand what we mean when we refer to “investing.” Traditional savings accounts prioritize security and short-term goals, whereas investment accounts aim to grow wealth by leveraging compound returns through stocks, bonds, and other assets.

By recognizing how compounding interest works over time and choosing the right strategy that meets one’s needs, individuals can maximize their financial growth that will transform their financial future and help them achieve long-term financial success.

At its core, compound interest is the process where your money grows, not only on the initial investment, called the “principal,” but also on the accumulated interest that is reinvested in the account. For example, if someone purchases $1,000 worth of stocks and bonds with an annual growth rate of 5%, they would have earned $50 ($1,000 X 5%) in the first year. In the second year, that account would grow based on the full value of $1,050 and would earn $52.50 ($1,050 X 5%). Throughout the years, this snowball effect becomes significant especially if the investor continues to reinvest the earnings.

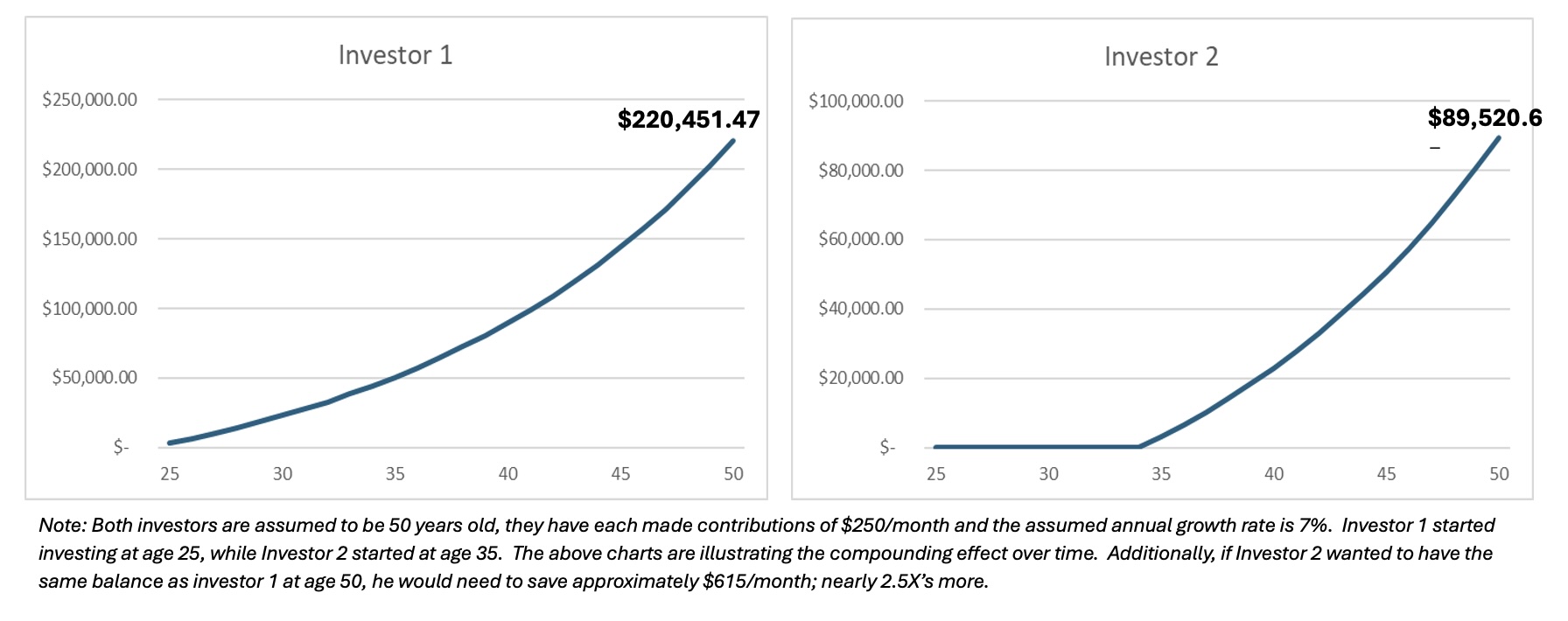

The earlier an individual starts investing, the more time the funds have to grow, so opening an investment account early is important. Here is an example of two investors. Both investors are 50 years old and are contributing the same monthly amount to their investment account where they have purchased a mixture of stocks and bonds. The difference in the two investors is that the first investor started contributing to the account at age 25 while the second investor did not contribute until age 35.

The charts above demonstrate how individuals who begin to save and invest earlier are able to take advantage of the compounding effect. However, delayed savings can drastically impact an individual’s financial situation and goals.

Another focus area that arises when one is looking to understand compounding interest is the Rule of 72. This is a simple formula that estimates how long it takes for an individual’s investment to double given the annual return rate. For instance, if someone earns 8% annually it would double in 9 years (72/8 = 9).

This is a great rule to use as a shortcut to calculate how long it would take to double an investment based on various rates of return.

To maximize the benefits of compounding interest and the rule of 72, you should consider the following:

- Start early: The earlier an individual starts to invest, the more time their money has to grow.

- Be consistent: Make regular contributions, even during market downturns. This typically allows the investor to purchase at a discount.

- Reinvest earnings: Have the dividends, growth, and capital gains stay in the account for reinvesting. This plays a big part in compounding interest as it greatly impacts how much the investor will earn over time. Additionally, the investor should consider the investment allocation of the account. Investments like stocks or mutual funds offer a higher potential return, however it’s important to consider one’s own risk tolerance.

- Be patient: Compounding works best over decades, avoid the temptation to dip into the investments prematurely.

The principles of compounding interest and the Rule of 72 are great building blocks toward wealth creation. Whether you are a beginner investor or an experienced saver, applying these tools can help build financial security and achieve goals faster. Small consistent steps today can make a significant impact in the future. Speak to a Southside Bank Wealth Management & Trust Officer today to explore investment solutions and start leveraging the power of compounding today.

The information provided in this article is for general informational purposes only and should not be construed as financial advice. Before making any financial decisions, it is strongly recommended that you consult with a certified financial planner™, attorney, accountant, or another trusted financial professional to assess your individual circumstances.

We want you to know that investment products provided by Southside Wealth Management & Trust: Are Not Insured by the FDIC or Any Federal Government Agency | May Lose Value | Are Subject to Risk | Are Not Bank Guaranteed | Are Not Deposits

Most Recent

Southside Bank Announces Relocation of Granbury Branch to Newly Constructed Facility

Southside Bank announced the relocation of its Granbury branch to a newly constructed, standalone facility designed to better serve its...

Southside Bank Announces Opening of New Branch in West Tyler’s Bellwood Park Development

Southside Bank is pleased to announce the opening of its newest branch in the Bellwood Park area of west Tyler....

Building Financial Security: Key Milestones at Every Stage of Life

By Callie Morgan, CFP®Financial planning is a lifelong process, and certain milestones serve as critical checkpoints for reviewing and adjusting...

Holiday Recipes That Don't Break The Bank

The holiday season is here again! It’s a magical time where we get to make good memories and great food....