From Small Steps to Big Savings: The Impact of Gradually Increasing 401(k) Contributions

By Callie Morgan, CFP®

Many people struggle with setting aside money for retirement. There are many ways to save for retirement, but a 401(k) is the most common method. Statistics show that around 56% of full and part-time workers participated in a workplace retirement plan in 2023 and on average contributed roughly 8% of their income.1 2 Typically, finance professionals recommend a savings rate of 15-20% of income for retirement needs.

If you fall short of this saving recommendation, don’t worry; a simple yet powerful strategy is to increase annual contributions gradually. Even small incremental increases can have a huge impact, thanks to the power of compounding. By making this a habit, an investor can have a more comfortable retirement with minimal impact on their current lifestyle.

The Concept of Annual Contribution Increases

Being hesitant to save more money is a normal feeling. It’s easy to believe you simply cannot afford to contribute more. However, gradually increasing contributions makes the process manageable. Here are some standard methods:

- Auto-increases annually: Some employer plans allow employees to enroll in automatic annual increases up to a maximum amount. The auto increase option will be specific to the plan, so understanding what your plan offers is important. Essentially, the investor will request a percentage increase to their annual contributions every year until the contribution reaches the specified maximum. For example, the account owner will contribute 8% starting in 2025 but has requested a 1% annual increase up to a maximum of 15% of income. This 1% increase will occur every year for 7 years.

- Manual increases: If the plan does not allow for automatic increases annually, the account owner can manually increase contributions annually. Using calendar reminders will help the investor remember to update their contribution.

- Tie increases to raises or bonuses: When you receive a raise, make it a habit to also increase the 401(k) contribution by at least a portion of the raise. This is a great way to save more without feeling a difference in paychecks.

The Power of Compounding in a 401(k)

Compounding is one of the most powerful tools in investing. Compounding occurs when one allows all earnings from investments to be reinvested in the market, creating a snowball effect (read more here). The more money that stays invested earning interest and dividends, the more one will earn, and the best thing about traditional (pre-tax) 401(k)s is all earnings and investment growth are tax-deferred, meaning no taxes are paid until the account owner withdraws from the account. Because of the compounding effect and tax-deferred growth, one can grow their retirement savings exponentially over time. Additionally, if the employer offers a matching contribution, make sure to at least contribute up to the match and take full advantage of this free money.

The current maximum contribution for 2025 is $23,500, this allows an employee to put away a large amount of money every year, especially if they are maximizing their contributions. 401(k)s also have catch-up contributions for those who are aged 50 and above; they can contribute an additional $7,500 in 2025.

Starting in 2025, individuals who are 60, 61, 62, and 63 have the option to participate in a super catch-up contribution, allowing them to contribute up to $11,250 plus the normal contribution of $23,500; for a total annual contribution of $34,750 (this is optional and not mandatory; speak to your employer to ensure the super catch-up contribution is available to you).3

Examples: How Small Increases Add Up

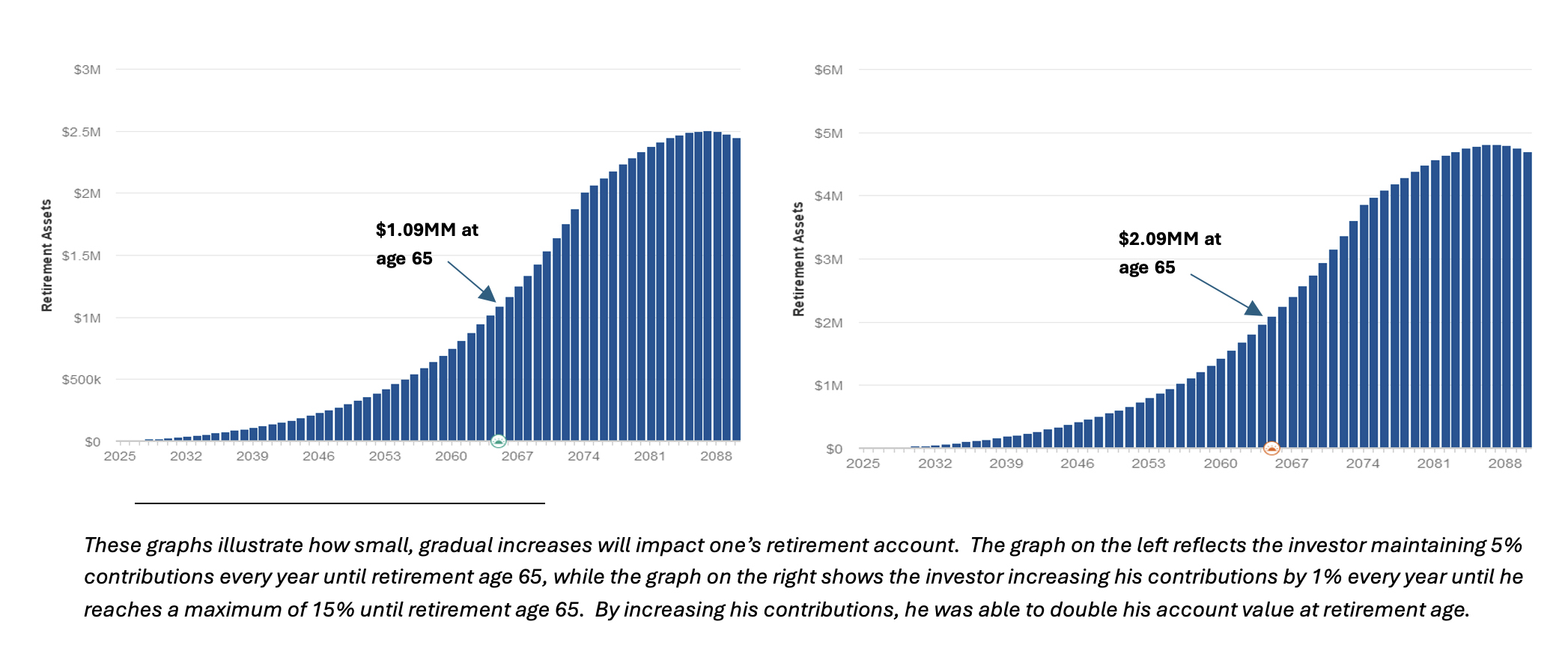

Let’s compare two hypothetical scenarios to see how small increases impact retirement savings (these are not guaranteed growth charts and are purely an example). We have an employee (age 25) who makes $50,000/yr (he assumes he will receive a 2% raise every year). His initial contribution is 5% ($2,500/yr) and his employer’s match contribution is 100% up to 3%, he assumes his account will grow 7%/year. He would like to understand how his account will perform over the next 40 years, and he wants to compare keeping his contribution at 5% every year versus increasing his contribution by 1% annually up to a 15% maximum.

Overcoming Common Barriers to Increasing Contributions

As we saw in the scenario, increasing contributions can be very beneficial; however, many people hesitate due to financial concerns. Here are some common obstacles and ways to overcome them.

- “I can’t afford to save more.”

- Start small. Contribute enough to receive the employer match, if offered, then increase savings by 1% every year.

- “I don’t want to reduce my take-home pay.”

- A slight increase will not drastically change your paycheck, especially if contributions are pre-tax. Pre-tax contributions will help reduce taxable income, thus reducing taxes that are being taken out of the paycheck.

- “I’ll start saving more later.”

- Delaying can cost you. The sooner you start saving, the more you benefit from compounding. Start saving today!

Additional Benefits of Increasing 401(k) Contributions

Beyond the long-term financial growth, increasing 401(k) contributions comes with other advantages as well, such as:

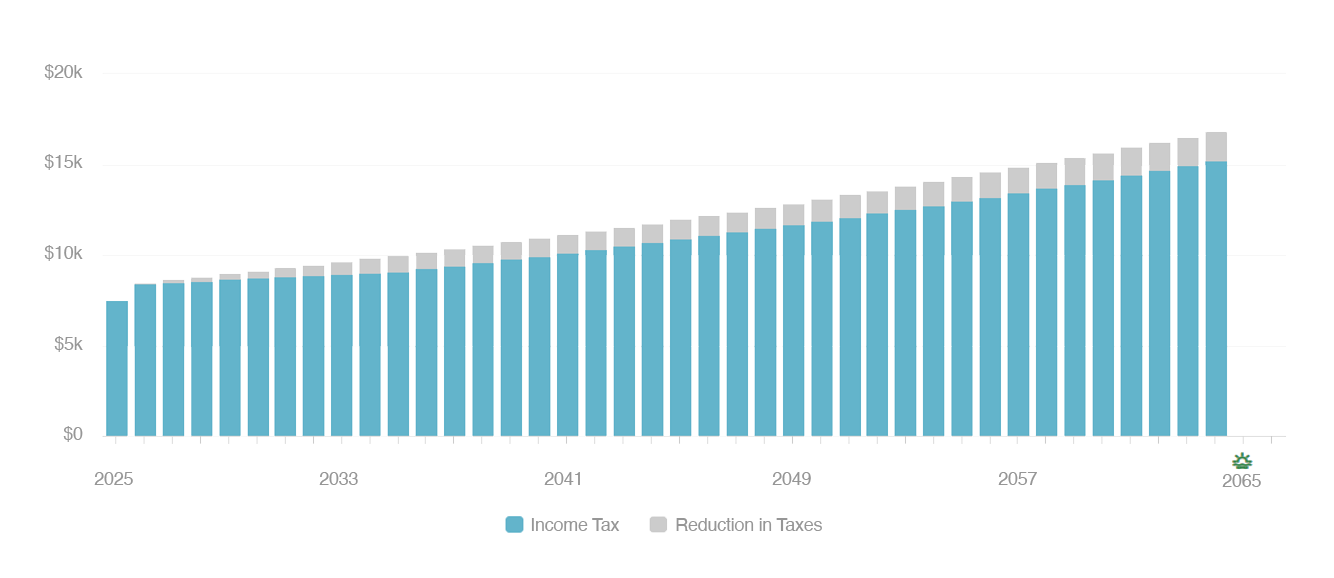

- Tax benefits: Pre-tax contributions reduce taxable income, potentially lowering one’s tax bill. Using the hypothetical investor from the example above, this chart shows how increasing contributions affected his income tax. By saving more for retirement, he was able to take advantage of tax savings during working years and saved roughly $41k over 40 years in income taxes (note: no other factors are being considered in the hypothetical illustration, only contributions to the investors retirement account). Although this investor was able to save income taxes during his working years, he could pay more in taxes during his required minimum distribution years. Remember, individuals can take advantage of the ROTH component of the retirement plan, which means the individual will pay income tax when they contribute, but the growth and withdrawals are tax-free. To better understand how much should be invested in pre-versus after-tax speak to a financial planner today to learn more.

- Financial security: Saving early allows an investor to maximize compounding, and having a larger retirement fund gives more flexibility and peace of mind.

- Better spending habits: Committing to saving first can help curb unnecessary spending. Additionally, using the “pay yourself first” mentality allows an individual to put away money for retirement first, then easily budget the remaining paycheck received.

Conclusion

Increasing 401(k) contributions annually is an easy and effective way to build long-term wealth. By making minor, consistent adjustments, one can take full advantage of compounding, employer matches, and tax benefits – all leading to a more secure and comfortable retirement. Speak to a Southside Bank Wealth Management & Trust Officer today to learn more.

1https://pensionrights.org/resource/how-many-american-workers-participate-in-workplace-retirement-plans/

2https://www.hicapitalize.com/resources/average-401k-contributions/#:~:text=The%20percentage%20of%20income%20contributed,in%20401(k)%20plans.

3https://www.irs.gov/newsroom/401k-limit-increases-to-23500-for-2025-ira-limit-remains-7000

The information provided in this article is for general informational purposes only and should not be construed as financial advice. Before making any financial decisions, it is strongly recommended that you consult with a certified financial planner™, attorney, accountant, or another trusted financial professional to assess your individual circumstances.

We want you to know that investment products provided by Southside Wealth Management & Trust: Are Not Insured by the FDIC or Any Federal Government Agency | May Lose Value | Are Subject to Risk | Are Not Bank Guaranteed | Are Not Deposits

Most Recent

Building Financial Security: Key Milestones at Every Stage of Life

By Callie Morgan, CFP®Financial planning is a lifelong process, and certain milestones serve as critical checkpoints for reviewing and adjusting...

Holiday Recipes That Don't Break The Bank

The holiday season is here again! It’s a magical time where we get to make good memories and great food....

Jeb W. Jones Elected to Southside Bancshares, Inc. Board of Directors

On October 16, 2025, the Board of Directors (the “Board”) of Southside Bancshares, Inc. (the “Company”) and Southside Bank (the...

Raymond C. McKinney, CPA Elected to Southside Bancshares, Inc. Board of Directors

On October 16, 2025, the Board of Directors (the “Board”) of Southside Bancshares, Inc. (the “Company”) and Southside Bank (the...