The Importance of Beneficiary Designations

Beneficiary designations play a critical role in estate planning because they determine who receives assets like retirement accounts, life insurance policies, and payable-on-death (POD) accounts at the account owner’s death. Properly structuring beneficiary designations that align with one’s goals and estate plan streamlines wealth transfer, helps reduce or eliminate probate costs, and provides financial security to loved ones.

What are Beneficiary Designations?

Beneficiary designations allow an account owner to name an individual(s) or entity(ies) to receive specific financial assets upon one’s death while avoiding the probate process. Furthermore, beneficiary designations override wills and trusts, which is why it’s important to make sure beneficiary designations and estate planning documents align appropriately to an individual’s goals.

For example, Joy is 85 and has two adult children (Ray (60) and Sarah (58)). Ray lives near Joy and takes care of her day to day needs along with her finances since Sarah lives in another state. Joy adds Ray to her checking account as a joint owner with rights of survivorship however her Last Will and Testament states that all assets should be split 50/50 between her children. At Joy’s passing 100% of the checking account will go to Ray although the will stated differently because the account was owned jointly with rights of survivorship. Now it is up to Ray to give half to his sister and follow through with Joy’s wishes. Additionally, this account will not have to go through probate since Ray was a joint owner. Instead of adding Ray as a joint owner to the checking account inadvertently giving the account to him at Joy’s passing, she could have given Ray the authority as power of attorney to conduct business over her financial assets. There are many types of power of attorneys that authorize certain powers depending on the individual’s unique situation and each should be carefully vetted. Guidance from an attorney and team of advisors is important to implement this strategy appropriately.

Below is a list of common assets/account types with beneficiary designations:

- Retirement accounts (401(k), IRA, pension plan)

- Life insurance policies

- Annuities

- Bank accounts (checking, savings, CDs)

- Investment accounts with transfer-on-death (TOD) provisions

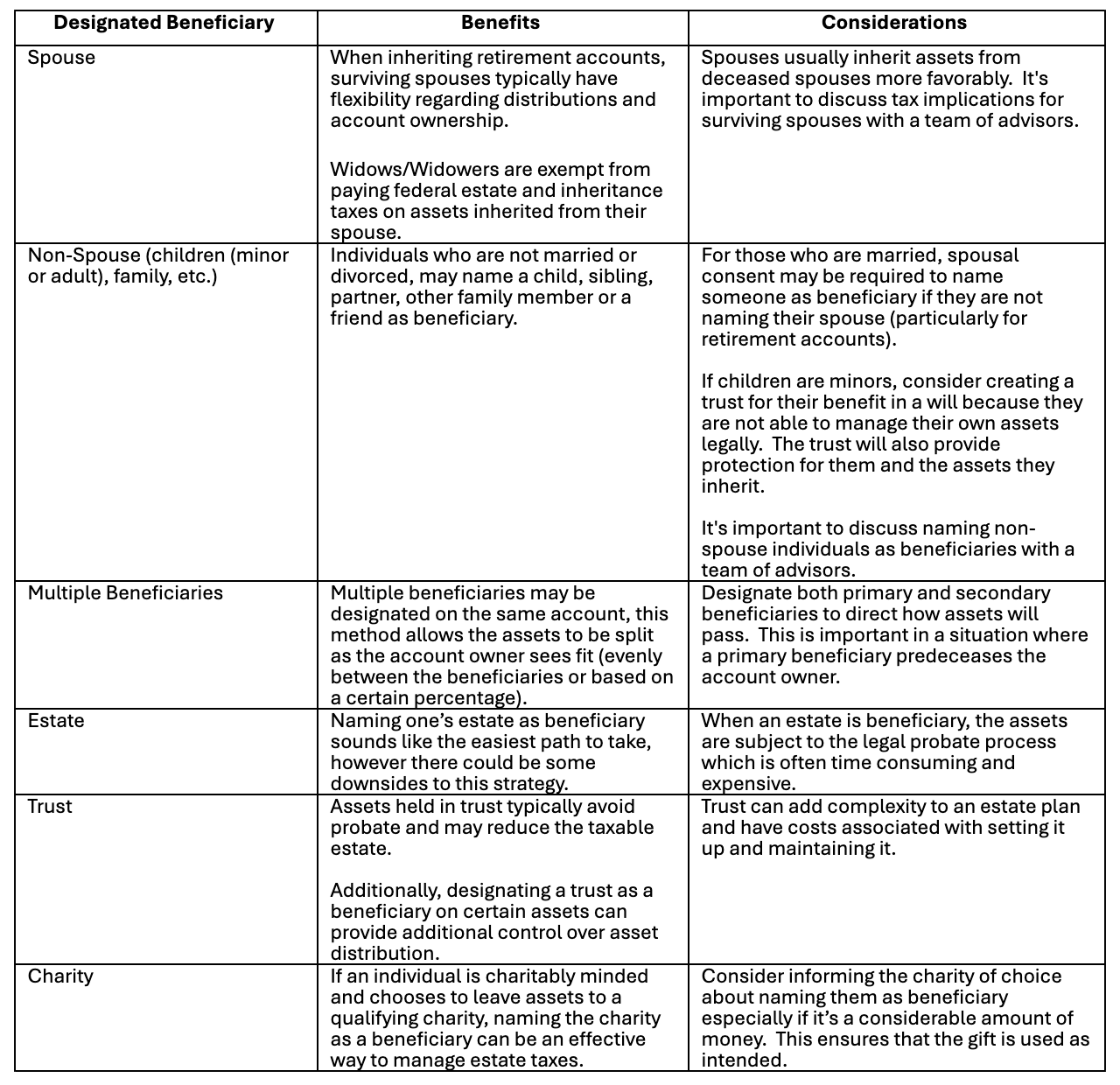

Beneficiary Designations and Considerations

Naming beneficiaries in your will, life insurance, and financial accounts is a key part of ensuring assets are distributed according to one’s wishes. Additionally, one should consider tax implications of certain types of accounts when naming a beneficiary such as a retirement account. Retirement accounts are specifically important because they have their own set of rules when being inherited by a person. Since beneficiary designations can be changed or updated easily, it’s important to review designations at least annually to ensure assets will be distributed properly. Below is a table that walks through some beneficiary types and considerations:

Conclusion

In summary, beneficiary designations are a powerful estate planning tool that ensures a smooth transfer of assets. Account owners should review and update them often so that assets are inherited according to the account owners wishes. Naming contingent or secondary beneficiaries are equally as important as the primary beneficiary. This provides additional protection in case a primary beneficiary predeceases the account owner.

One last thing to note: people often ask if their heirs will be required to pay taxes on assets they inherit. Although there can be a lot of complexity to this question, the short answer is no, those who inherit don’t pay taxes on what they receive. However, those who are giving the inheritance (or gift) could be responsible for the tax depending on several different factors. It’s important to consult with an attorney, CPA, and financial advising team to understand one’s unique situation. Contact a Southside Wealth Management & Trust officer today to do a deep dive of your beneficiary designations and estate plan to learn more.

The information provided in this article is for general informational purposes only and should not be construed as financial advice. Before making any financial decisions, it is strongly recommended that you consult with a Certified Financial Planner™, attorney, accountant, or another trusted financial professional to assess your individual circumstances.

We want you to know that investment products provided by Southside Wealth Management & Trust: Are Not Insured by the FDIC or Any Federal Government Agency | May Lose Value | Are Subject to Risk | Are Not Bank Guaranteed | Are Not Deposits

Most Recent

Building Financial Security: Key Milestones at Every Stage of Life

By Callie Morgan, CFP®Financial planning is a lifelong process, and certain milestones serve as critical checkpoints for reviewing and adjusting...

Holiday Recipes That Don't Break The Bank

The holiday season is here again! It’s a magical time where we get to make good memories and great food....

From Small Steps to Big Savings: The Impact of Gradually Increasing 401(k) Contributions

By Callie Morgan, CFP®Many people struggle with setting aside money for retirement. There are many ways to save for retirement, but...

Raymond C. McKinney, CPA Elected to Southside Bancshares, Inc. Board of Directors

On October 16, 2025, the Board of Directors (the “Board”) of Southside Bancshares, Inc. (the “Company”) and Southside Bank (the...